Recent News

Maryland Proton Treatment Center raises $277M in bond deal to stabilize financesPublish Date

Source

Industry

Banking & Financial / Healthcare

Company

The center raised the capital through the sale of tax-free municipal bonds as part of a deal backed by the Public Finance Authority of Wisconsin.

Located at the University of Maryland BioPark, the 110,000-square-foot cancer treatment facility has faced challenges in drawing enough patients to reach profitability.

Jason Pappas, former acting CEO and current board chairman, said the bond deal puts the proton center on “more stable footing” financially, so it can better focus on bolstering its clinical care efforts and increasing patient volumes. The center had been considering several options to reduce debt, including potentially becoming a nonprofit, but Pappas said municipal bonds ultimately offered the best long-term outlook.

Under the new financing deal, parent company Maryland Proton Treatment Holdings LLC has agreed to lease the assets of the treatment center to the Public Finance Authority, a public bond-issuing agency that aims to help streamline economic development projects. Essentially, that means the Public Finance Authority now owns the Maryland Proton Treatment Center’s building, the land it sits on and all the equipment and fixtures inside it.

The Public Finance Authority is a Wisconsin-based quasi-governmental agency that has issuances across the country.

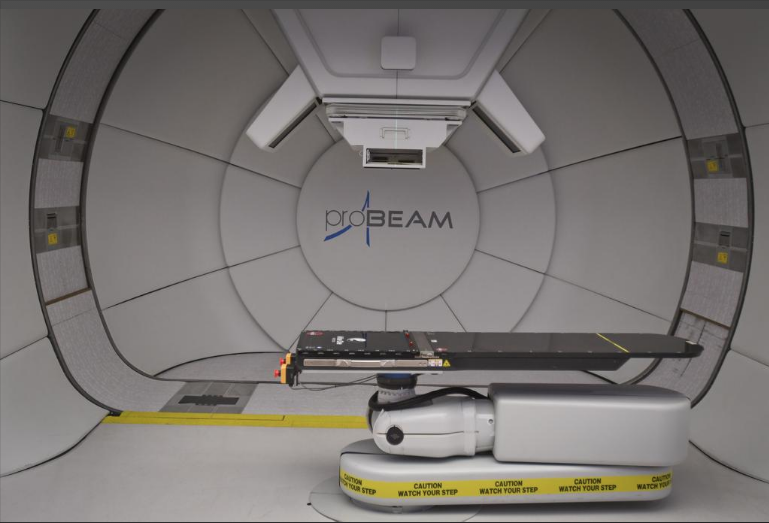

About $300 million went into the building and startup of the proton center in Baltimore, including nearly $100 million in technology.

The new $277.4 million financing deal will not cause any noticeable changes for patients and affiliates of the Maryland Proton Treatment Center, Pappas said. Under a long-term agreement, the center’s executives, medical experts from the University of Maryland School of Medicine, staff from the University of Maryland Medical Center and partnering health systems and practices will continue to operate the center as before.